Valor Inicial SVA

USD 1.00

Valor actual SVA

El Proyecto

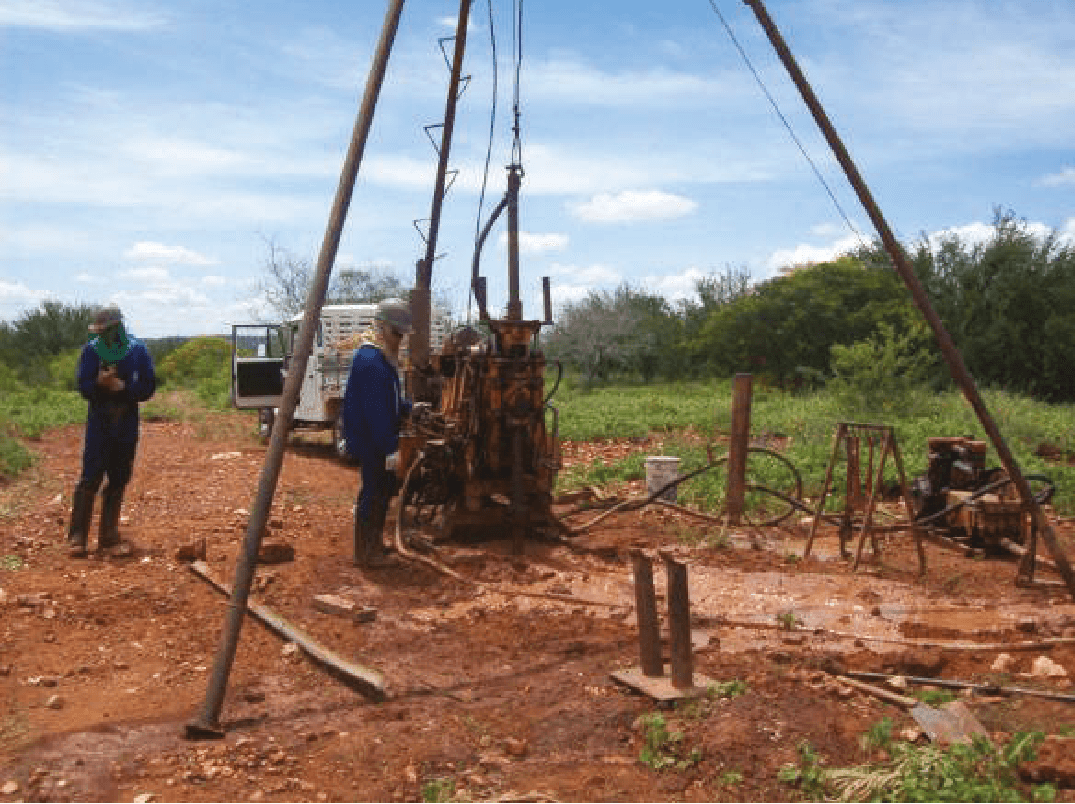

Supernova Mine - Piauí, Brazil

Riacho Seco Mine - Piauí, Brazil

"474 TONELADAS DE ORO EN RESERVAS"

Serrinha - Brazil

MS - Brazil

Sulfide I - Brazil

Sulfide II - Brazil

Barda - Argentina

Adarle - Argentina

La Oferta

ROI from Increase in Price

An increase in the price of the underlying mineral increases the value of the entire company and the value of our SVA tokens. With the current increase in global demand and an historical rate of growth of ~ 7.98% per year, we estimate a gold price per ounce of ~ USD 7,340 in 10 years.

ROI from Increase in Assets

An increase in our gold reserves increases the value of the entire company and the value of our capped SVA tokens. Through new exploration campaigns in current and coming mines, cubication and certification we project a level of Reserves of 1,500 tons in 10 years.

ROI from Gold Production

Once production starts, the DCF Value of these assets increases throughout the life cycle of the mines, increasing the value of the entire company and the value of our SVA tokens. Based on our gold production estimates, we project a DCF Value increase to 25% in 10 years.

"474 TONELADAS DE ORO EN RESERVAS"

"474 TONELADAS DE ORO EN RESERVAS"

Reservas Minerales - Activos Tokenizados

Nombre del activo:

El Proyecto Supernova está compuesto por:

(1) Supernova sn 1987 a SPE LTDA

(2) Riacho Seco Mineração S.A.

Ubicación del activo

Paulistana, Piauí, Brasil

Reservas en el activo (toneladas)

474 toneladas de oro

Reservas en el activo (onzas)

15,168,000 onzas de oro

Precio de la onza en la emisión

USD 2,426

Valor económico de la reserva en la emisión

USD 36.8 mil millones

Valor descontado del activo en la emisión

USD 4.6 mil millones

Entidad legal que posee los activos - Emisor de SVA

SVA Security Tokens

Memorando de Colocación Privada

Tipo de inversión

Colocación privada bajo la Regulación D de la SEC, Regla 506(c) y Regulación S.

Fecha de inicio

1 de septiembre de 2024.

Inversores permitidos

Inversores acreditados de EE.UU. e inversores no estadounidenses.

Suscripción máxima

50 millones de unidades de membresía (tokens SVA).

Compra mínima por inversor

100,000 unidades de membresía (tokens SVA).

Precio de oferta del token

USD 1.00

Moneda de compra

FIAT (USD / EUR / CHF / GBP)

Stablecoin (USDT / USDC)

Descuento ofrecido

50% para los primeros USD 10 millones recaudados.

25% para los siguientes USD 10 millones recaudados.

Fecha de terminación

28 de febrero de 2025.